Published on Jan. 5, 2026

Surging Demand and Mounting Pressures in the UK Egg Sector

As egg producers experience the strongest demand in years, Nick Bailey explains how a drop in placings followed by an unprecedented bounce back has put pressure on the entire value chain.

As recently as February 2023, I wrote a piece bemoaning the egg shortages caused by producers leaving the sector, many driven from egg production by a perfect storm of rising input costs colliding with contracts negotiated when costs were lower and eggs were in surplus. For a hatchery, the exodus of producers had obvious implications, and demand for day old chicks stalled.

Commercial flocks now average 430 eggs per cycle and yield a staggering 9,500 eggs per ton of feed, with free range flocks of Dekalb White regularly achieving 500 eggs per hen housed, over 100-week cycles, whilst our brown birds are showing extraordinary persistency over significantly longer cycles.

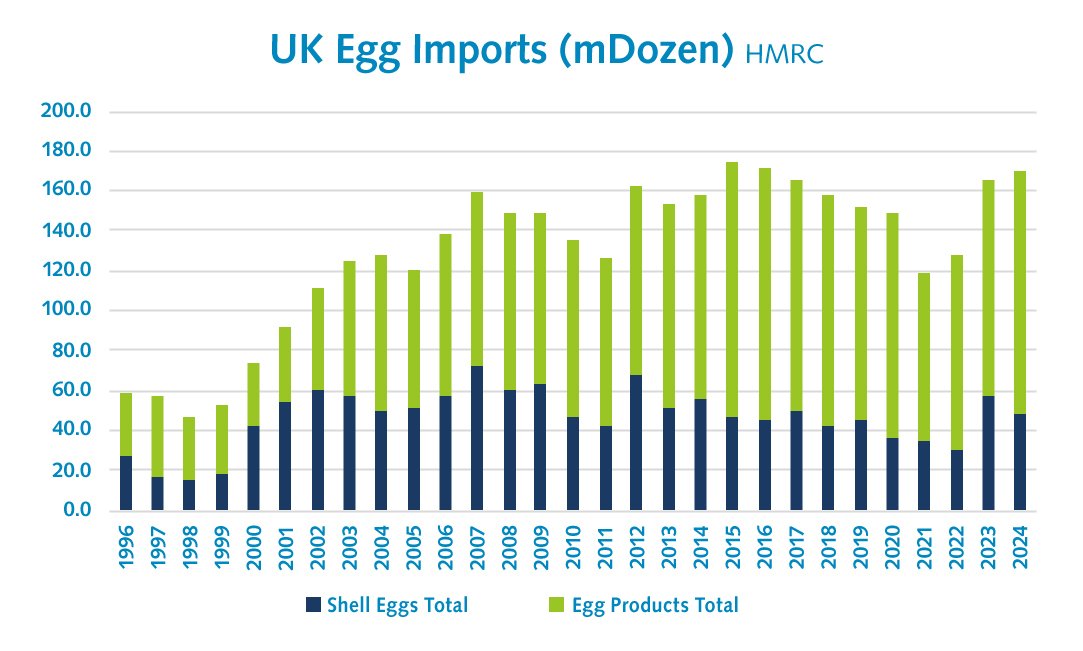

Despite this extraordinary progress, back in 2023, the industry was unable to fulfil the demand for eggs. Eggs had fallen into shortage and retailers had begun to stock European eggs not produced to the higher standards required by UK codes of practice such as the Lion Code.

Those observations made nearly three years ago are hauntingly apposite today, as once again imports grow to fill the shortfall.

Such imports create a salmonella risk and are a potential public health issue because production standards in source countries are often lower than those required by UK Lion Egg producers. Indeed, recent UK salmonella cases have been linked to an egg importer.

After years of hard-fought work by the UK industry to restore public trust, following the scandal of the late 1980s, it is worrying to see this emerging threat to the reputation of eggs as safe for everyone!

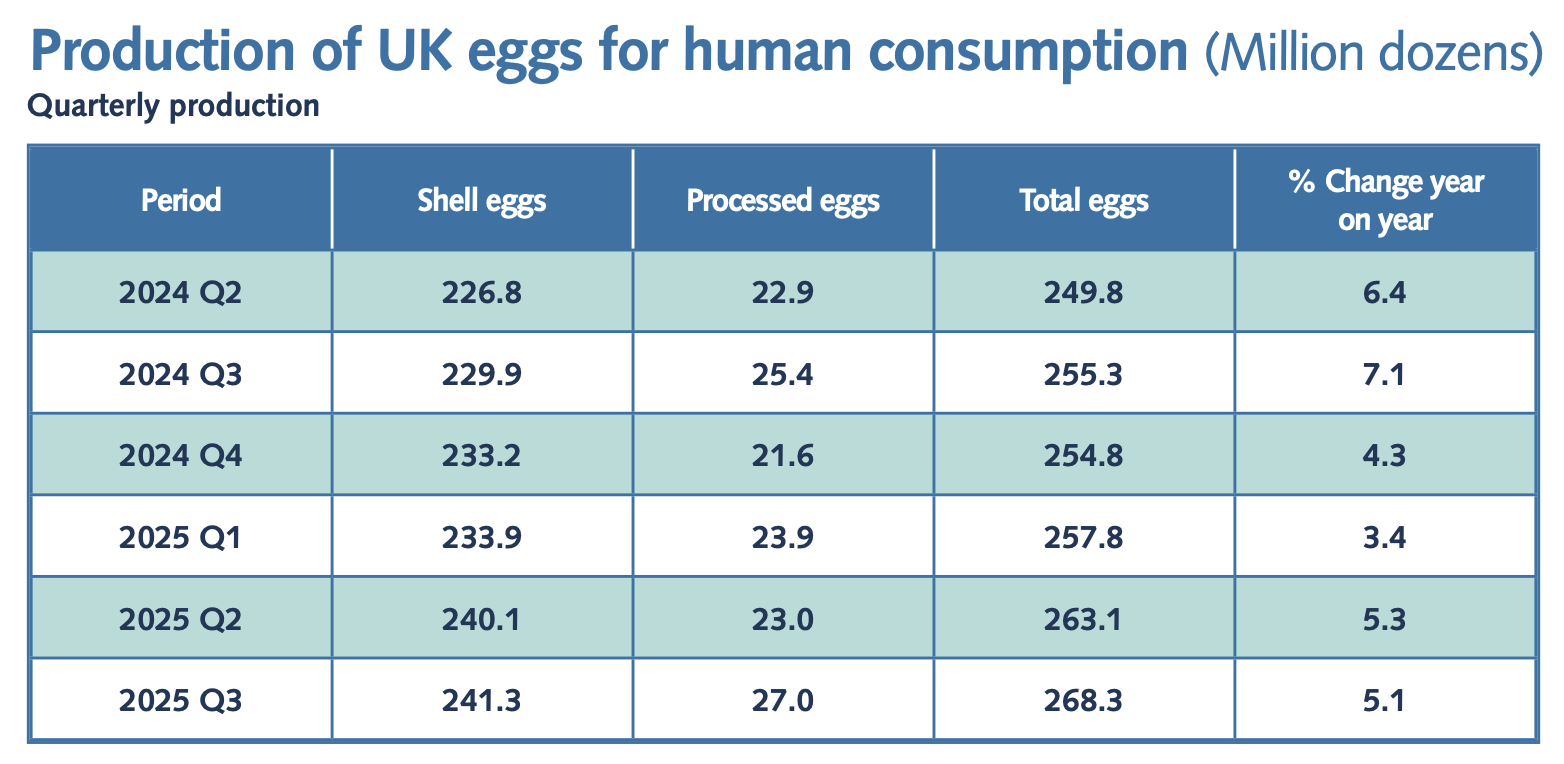

In 2025 the UK laying flock is on course to return to its highest level for four years after a surge in pullet placings in recent months, driven by unprecedented demand, as producers return to the market driven by attractive returns.

As poultry.network put it in March, “From November to January, chick numbers were up by 2.3m on the same period a year earlier. Taken over the past 12 months, the year-on-year increase has been 3.5m. Despite this expansion, the UK egg market remains critically short of eggs overall.”

Compared with the early 2000s, annual production has risen by roughly 4 billion eggs. The British Lion mark continues to reinforce confidence, old concerns about cholesterol have receded and eggs are now widely regarded as healthy, safe, and convenient.

The reality is that egg producers are experiencing their strongest demand in years, with retailers reporting record sales. Per capita, UK egg consumption continues to rise across all demographics, with total UK egg consumption reaching 13.5 billion in 2024, up 6% from 2023. In the four weeks to late October, prices increased 8.3% year-on-year, while retail sales over the 52 weeks to early November rose 5.1%. Such growth is particularly notable in a mass market.

The UK egg sector is reacting to the move to non-cage eggs, by cutting colony places and huge free-range expansion, whilst barn remains a small and misunderstood sector, with few players. The move to white egg layers is gathering pace, accounting for circa 15% of the market.

Behind the scenes however, tensions are growing in a sector that despite expanding rapidly is unable to meet demand. The transition to free-range, planning restrictions, competition for farm capacity amongst rearing, parent stock and producers, lower stocking densities in broiler farms, and per capita consumption increases, all feed into a complex and supply chain which currently simply cannot meet demand.

UK hatcheries are feeling the effects of these rapid changes in demand, and this is exacerbated by the lack of opportunities to contract additional hatching egg production. UK hatcheries have the theoretical capacity to satisfy UK demand from domestic producers; however, they are constrained by the amount of available of hatching eggs available from parent stock farms. Availability of farms suitable for parent stock and parent stock rearing farms is limited, and different parts of the supply chain are competing for what is available, at a time when many sites need modernisation and rebuilding.

Responding to the surge in demand for layer chicks is therefore no simple matter and shortages are a source of tension across the supply chain.

Our new standards, launched at BFREPA, include longer cycles in brown and white breeds with incredible liveability and persistence to the end of lay, whilst at the same time efficiency at the layer farms, optimisation of hatching eggs are phenomenal, with utilisation at 95 – 98%. Indeed, flock after flock of Dekalb White layers are achieving the magic 500 eggs per cycle, recording excellent feed conversion, low mortality, excellent feathering, and generally demonstrating the ease of management that so endears them to producers. Despite these achievements it is a source of huge disappointment and concern when we cannot fulfil the demand from loyal customers.

In response we have launched an ambitious investment plan to accelerate our capacity to meet customer needs. This includes additional setters, expansion and modernisation of our own parent stock farms, and ensuring our planning and production is optimal. One concern is the number of late changes hatcheries receive to orders which can compromise efficient use of hatchery space and lead to the wastage of hatching eggs. These changes can often come from late confirmation or alterations to dates from egg producers who are not directly receiving the chicks, which they buy through a pullet rearer.

It is the source of great satisfaction to see the egg sector bouncing back so strongly, and a testament to the popularity of both our white and brown breeds that our order book is so strong. Undeniably availability is tight, and we would ask customers to place orders as early as possible to lock in supply. The position regarding availability is dynamic, so we do encourage our customers to contact their area representative to check on the up-to-date availability. As Fred Pontin once said - Book Early!